"What's going on in Crypto?" 101

By a Crypto Dummy, For Dummies 🙂

On Friday, I shared my thoughts on Notion about what’s been going on in crypto.

It was pretty 101-esque in nature, so I’m cross-posting it as the first “101” in this newsletter.

Since I have a grand total of roughly five subscribers right now, I’d love to hear from each of you on what you think — the good, the bad, and the ugly — if you’re so inclined.

Happy Tuesday!

Annika

TL;DR

Crypto has absolutely taken off in the past month. The price of BTC has gone from $18K a month ago to $40K today. 🤯

The Scene

It's January 8th, 2021. Crypto-mania is afoot.

If you were in your parents' basement messing around with crypto over the break and had bought some Bitcoin on Christmas Eve, you'd be up a whopping 67% as of today, January 8th.

That works out to a 26,909,415% annualized return (yes, 26 million percent), if anyone's counting.

What is going on?!?

Me & Crypto

I'm a crypto dummy, which is why I'm writing for dummies. I'm not an expert seeking to educate. I'm humbly inviting you to come with me on my learning journey in this post. Tread with caution.

I started researching crypto a little back in 2016, but I didn't really spend much time on it until the COVID-19 crisis hit in 2020 and I started to think a lot about the future of money.

Apparently a lot of you are starting to get interested, too.

I'm new to this, and writing is one way I learn. Talking to other learners is another. If you like this piece and want to chat, HMU. And please alert me if I'm wrong on anything! If I didn't make it clear, I'm here to learn. 🙂

For disclosure's sake, I own a very small amount of Bitcoin and Ethereum.

In this piece, I'll cover:

What's been going on? (Alternate Heading: Q4 2020, when shit got real)

Why now?

What's ahead?

I'll focus on Bitcoin today, since that's where most of the mainstream discussion is.

What's been going on?

Mania, that's what.

An early glimmer of what was to come appeared in the summer, when software company MicroStrategy made a huge bet on Bitcoin. Not many mainstream folk took note at the time, but to the Crypto community, this was a big deal.

I'm not suggesting this was the trigger event, but this would be the first of many high-profile stories of established investors & companies entering the space at the end of 2020.

Microstrategy would end up investing over $1B in bitcoin before the year was up.

Yes, there's been lots of corporate crypto interest in the past — Facebook's Libra, JP Morgan's Digital Coin — but Q4 2020 was the first time we saw big-name, institutional investors speak with their dollars.

The floodgates opened, and like a flash in the pan, the market cap of cryptocurrencies suddenly topped $1 trillion.

Why now?

Ok, so money is pouring in — but why? Nobody's really using BTC to pay for their coffee, so why is it all of a sudden so valuable?

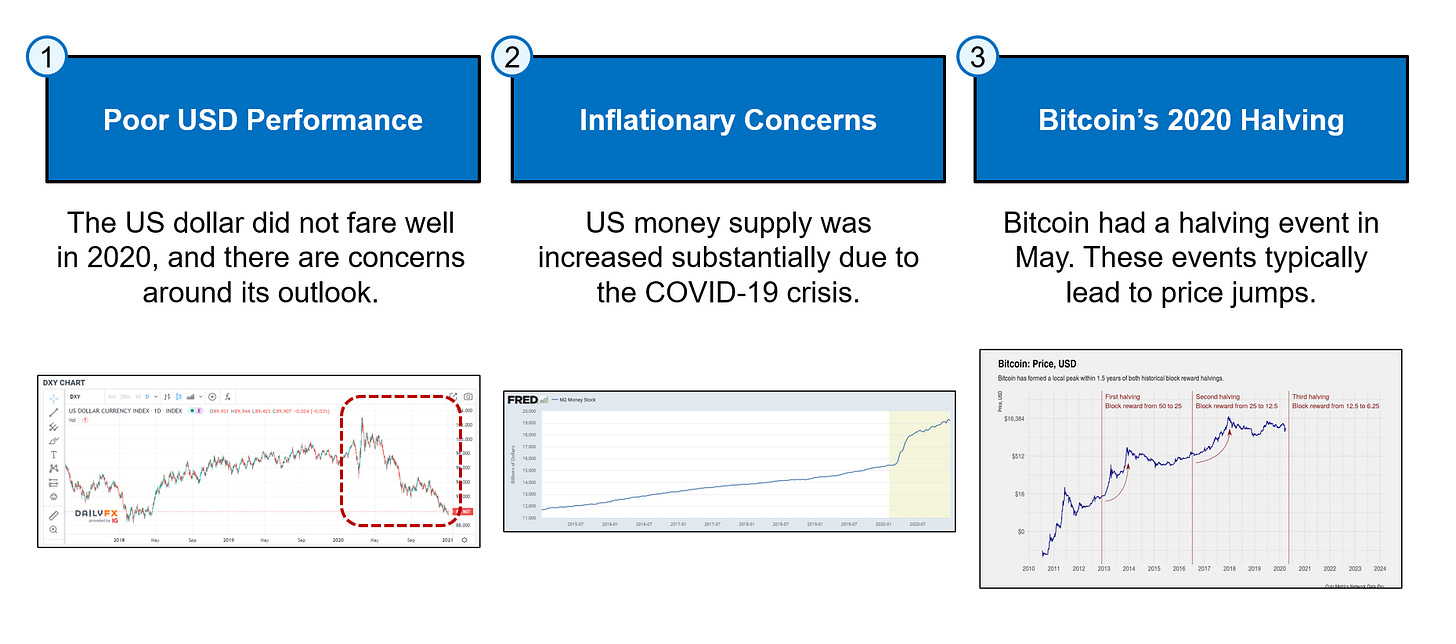

IMO, there are two over-arching drivers - the macroeconomic environment (including poor USD performance & inflationary concerns) & Bitcoin's halving.

On the macroeconomic front

Unless you've been living under a rock, you've heard about all the government stimulus resulting from the COVID-19 crisis. In the US there was the $2T CARES Act, in Canada there's the CERB and the CEWS (and more).

You or your company may even have been a recipient of COVID $.

Unfortunately, the money that was pumped into the economy didn't just exist - the governments had to create that money out of thin air. ✨

And when you create more of anything, the value of that thing decreases because there are more out there. Supply & demand stuff, which you already know.

There is now way more money in circulation. When people lose confidence in government-backed money's ability to hold its value, they often flock to hard assets: real things that have traditionally held value regardless of what a dollar is worth, like gold and real estate.

Some people think that Bitcoin will become a lasting alternative to those assets.

USD down, BTC up.

Is this fleeting or lasting? Time will tell ⏰

Bitcoin's 2020 Halving

One factor in this mania that not a lot of people are talking about is Bitcoin's halving event, which occurred in May 2020.

When Bitcoin was created, it was built into the system's design that after every 210,000 blocks mined (which currently works out to roughly every four years), the reward for mining a Bitcoin would decrease by half.

In May, it went from 12.5 —> 6.25 BTC/block mined.

I won't get into the details of halving - you can read about it yourself if you'd like.

All you need to know for now is that a thing happened, which has happened twice before and has (sensically) prompted a rise in the price of Bitcoin both times, and it's adding fuel to Bitcoin's recent ascent.

What's ahead?

It really feels like there are two distinct camps - the strong Bitcoin bulls and the strong bears.

The vocal people tend to be either hardcore HODLers or doubters, and I don't see a lot of writing from people taking a more nuanced view.

Personally, I do see potential for Bitcoin, but I do find it hard to believe we're not in any sort of bubble.

While Bitcoin may well never fall below the $20K mark again, the pace of the rise over the past few weeks screams speculation & FOMO and may lend itself to a pretty harsh correction.

What I'm looking out for in 2021 is to see real-world evidence of Bitcoin in practical use. If Bitcoin doesn't become entrenched in real-world applications, there is a part of me that still worries it might be the "MySpace of Crypto".

That, or it's full-on on a path towards becoming digital gold and I should be buying a lot more right this second.

While I've focused on Bitcoin here, Ethereum - which, too, has had a spectacular rise recently - is getting traction on the real-world application front, with the rise of Decentralized Finance (aka "DeFi"). More on that another day.

In the meantime, I can't wait to watch how things play out over the coming weeks. 👀